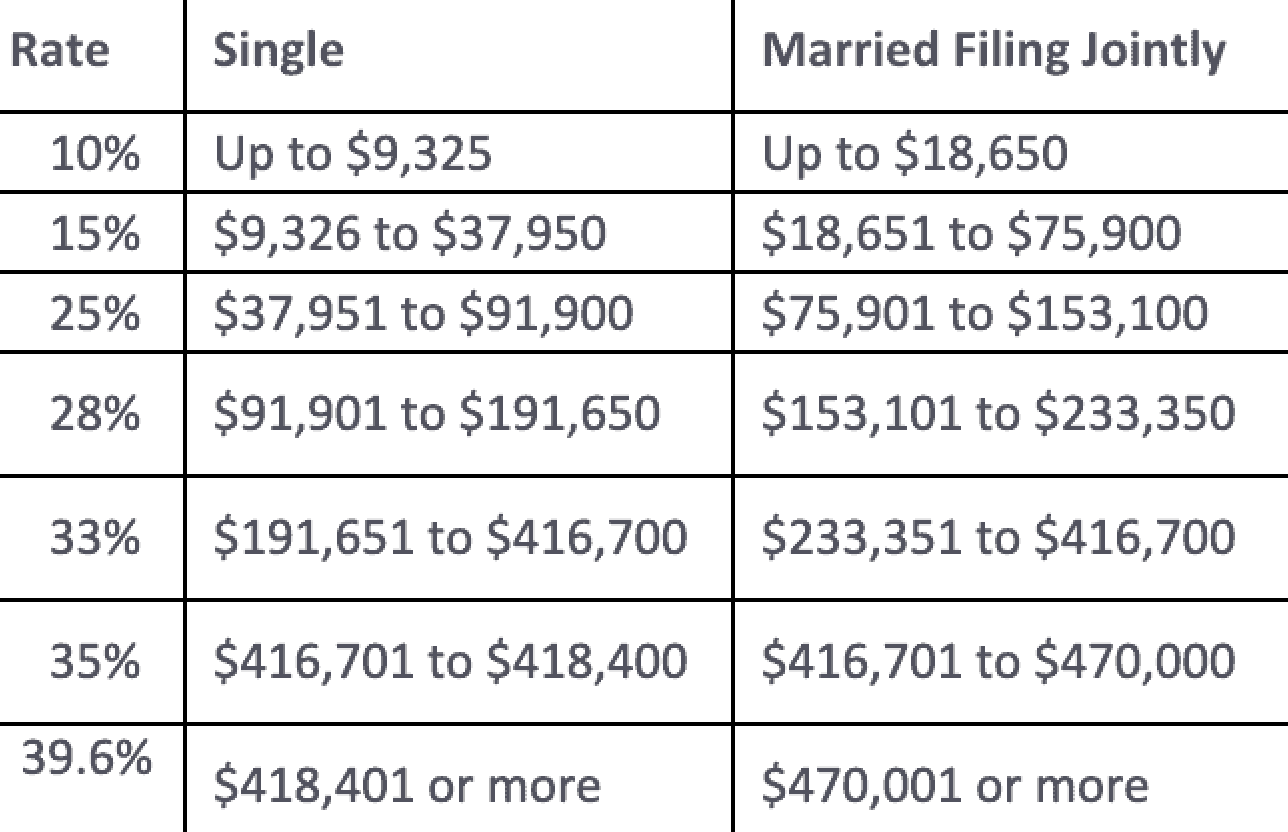

2025 Tax Brackets Table Irs. Calculate your personal tax rate based on. Washington — the internal revenue service announced today the annual inflation adjustments for tax year 2025.

In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). All net unearned income over a threshold amount of $2,700 for 2025 is taxed using the marginal tax and rates of the child’s.

In 2025, The Income Limits For All Tax Brackets And All Filers Will Be Adjusted For Inflation And Will Be As Follows (Table 1).

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Washington — the internal revenue service announced today the annual inflation adjustments for tax year 2025. There are seven (7) tax rates in 2025.

.02 Unearned Income Of Minor Children Subject To.

See the 2024 tax tables (for money you earned in 2024). Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027. Find the 2025 tax rates (for money you earn in 2025).

The United States Federal Income Tax System Is A Progressive System Where Different Portions Of Income Are Taxed At Different Rates.

The federal income tax has seven tax rates in 2025: For taxable years beginning in 2025, the tax rate tables under § 1. Calculate your personal tax rate based on.